Freelancer tips

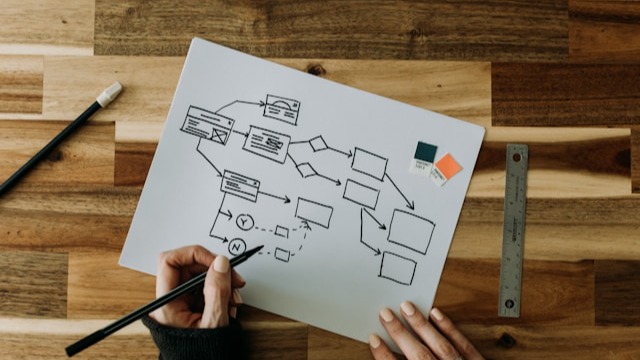

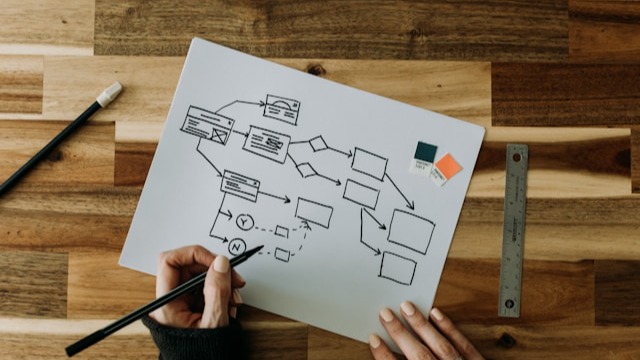

Freelancer tips Process Operations Diagram: What It Is and How to Make One

The process operations diagram helps organize tasks, improve productivity, and support better decision-making. Learn how to create one here.

A general partnership is a Mexican commercial company in which the partners are jointly and severally liable with their assets. This model, consisting of two or more partners, is regulated in Chapter II of the General Law on Commercial Companies (LGSM).

Would you like to know more about Mexican general partnerships?

In this post, we explain their characteristics, as well as the legal aspects, advantages, and disadvantages.

Commercial entities in Mexico are distinguished by elements that determine their formation and responsibilities. Each has particular features that help determine which is most suitable based on the partners’ profile.

For a General Partnership, these are the main characteristics:

It is based on mutual trust.

Partners’ liability is joint and several and unlimited.

It requires at least 2 persons, and contributions depend on the type of partner.

The registered business name (firm name) includes the name of one or more partners.

Below we explain each characteristic in more detail:

In a General Partnership, the relationship between partners is as important as the capital they contribute. It is characterized by mutual trust, involving not only investing money but also taking part in management and decision-making.

In a General Partnership, liability is unlimited and joint and several under Articles 25 and 26 of the General Law of Commercial Companies (Mexico).

In other words, partners assume a commitment beyond their capital contributions. This means that if the company cannot meet its financial obligations, they must respond with their own assets.

Likewise, it is a shared obligation that cannot be waived vis-à-vis third parties. Although a partner may be limited to a certain amount if the partners agree so in the partnership agreement.

To form this type of entity, at least two people are required. In addition, their contributions may be in the form of money, goods, or services. This depends on the types of partners in the general partnership and what is established in the partnership agreement.

The collective business name must include at least the name of one of the partners. Expressions such as “& Company” (or equivalent) are also used to indicate there are more members.

It is also a requirement to include the abbreviation that identifies the company type; in English we will refer to it simply as General Partnership.

Examples:

“Sanchez & Company, General Partnership”

“Lopez & Martinez, General Partnership”

If, for example, the partner with the surname “Lopez” withdraws from the company, the word “Successors” should be added to reflect the change. It would read:

“Lopez & Martinez, Successors, General Partnership”

However, companies may choose to change the firm name entirely instead of keeping it with the addition of “Successors.”

The General Partnership in Mexico is governed by a partnership agreement. This document sets the rules for making changes and the partners’ limitations in their actions within and outside the company:

Admission of new partners. As a rule, admitting a new partner requires unanimous approval, unless the agreement provides otherwise.

Assignment of partnership rights. No partner may sell or transfer their interest to a third party without the others’ authorization. If approved, current members have a right of first refusal to keep that interest.

Changes to the agreement. All votes are required to amend the partnership agreement. Except when the agreement allows decisions by majority, in which case the minority may withdraw.

No competition. A partner may not engage in businesses of the same line or join companies that do so without the others’ authorization. If they do, they may be excluded, lose benefits, and even owe damages.

The partnership agreement is essential because it governs the company’s life and sets partners’ rights and obligations.

The Mexican General Law of Commercial Companies allows the General Partnership to adapt to different organizational forms.

These variants are:

Fixed capital. The traditional form, where capital is set in the agreement and any change requires partners’ consent.

Variable capital. Partners may increase or reduce capital without amending the partnership agreement, pursuant to Articles 213 and 215. It is more flexible for new contributions or capital withdrawals.

In this case, what changes is how capital is managed.

If you are considering starting a business in Mexico, a General Partnership can be a good alternative. Beyond the aspects mentioned, keep the following in mind:

Among the advantages of a General Partnership are:

Simplified formation. Creating a General Partnership in Mexico requires fewer formalities than other company types.

Internal control. All members actively collaborate in management and major decisions.

Trust among partners. As it is based on personal relationships, it fosters greater commitment and seriousness.

Flexibility in agreements. Profit distribution and roles can be negotiated.

Legal recognition. Although simple, it has legal backing, which builds confidence with third parties.

Some disadvantages of the General Partnership are:

Exposure of personal assets. If the company cannot pay its debts, partners must use personal assets to cover them.

Complex entry or exit. Being admitted or withdrawing as a partner requires general authorization, which can create friction.

Dependence on current partners. Economic growth often depends on members’ contributions, limiting expansion capacity.

Therefore, it may be wise to evaluate other options, for example, a Limited Liability Company or a Partnership Limited by Shares. It all depends on your business needs.

If you want to form a General Partnership in Mexico, there are certain legal aspects you must comply with.

The basic steps are:

Draft the partnership agreement and define the registered business name.

Formalize before a notary and register the company with the Public Registry of Commerce.

Register the company with the Mexican Tax Administration Service to obtain the Federal Taxpayer Registry (RFC) and define the applicable tax regime.

These are the basic formal steps that ensure the company’s legal and tax validity in Mexico.

A General Partnership can be an attractive option for freelancers and professionals who want to set up their own practice. Even so, here is a comparison with a Limited Liability Company to give you a sense of the differences:

Aspect | General Partnership | Limited Liability Company |

Liability | Unlimited and joint and several: partners are liable even with personal assets. | Limited: partners are liable only up to their contributions. |

Minimum capital | No statutory minimum required. | No statutory minimum; set in the company agreement. |

Number of partners | At least 2. | From 2 up to 50. |

Entry and exit of partners | Requires consent of others and usually entails significant adjustments. | Can be set in the agreement; transfer of equity interests is simpler. |

The General Partnership has several significant advantages. It is a suitable option if you have reliable partners, want a structure that is simple to form, and gives you direct control over management.

However, committing your personal assets if results are not as expected is a major risk to consider. Other models may be more beneficial for you, depending on your projects.

In any case, if you want to plan for your business, check out our post with some examples of General Partnerships.

Meanwhile, DolarApp can be an alternative if you have international clients. With our app, it’s very easy to make transactions in digital dollars (USDc) and digital euros (EURc)—including transfers and currency conversions at a fair exchange rate.

The law requires a minimum of two partners and does not set a maximum. While very flexible, it is a structure based on trust and direct participation. So make sure you partner with people who are up to the task.

Yes. Liability is unlimited and joint and several as provided by law. Thus, if the company faces financial difficulties, creditors may pursue the partners, who must respond.

Article 29 of the General Law of Commercial Companies (Mexico) states that if a partner leaves, the company may keep the same collective firm name. However, to reflect this change, the word “Successors” must be added.

Sources:

Articles 25 and 26 of the General Law of Commercial Companies

Articles 213 and 215 of the General Law of Commercial Companies

The world has borders. Your finances don’t have to.

Freelancer tips

Freelancer tips The process operations diagram helps organize tasks, improve productivity, and support better decision-making. Learn how to create one here.

Freelancer tips

Freelancer tips A business brings new challenges and decisions as it scales. Learn the stages of business growth and identify which stage you’re in.

Freelancer tips

Freelancer tips A well-written privacy policy makes users trust your site more. Here are the necessary elements and a practical example to create one.