Your Money

Your Money What Is the Most Stable Currency in the World and Why?

The most stable currency in the world has managed to withstand crises, inflation, and political uncertainty. Discover which one it is and other stable currencies.

Has it ever happened to you that you need to send money urgently and the person you want to send it to doesn’t have an account with your same bank? Many Colombians face that same stress daily. Fortunately, there are systems like Transfiya in Colombia.

In this article, we’ll tell you how it works, how to activate it, and what limits apply depending on your bank. Learn how to move your money easily and instantly!

Transfiya is a way to send money between different banks and digital wallets in Colombia. This bank transfer system began operating in 2020 due to the need to simplify financial operations in the country.

This service allows you to send and receive money 24 hours a day, 7 days a week, every day of the year. Its operating costs may vary depending on the institution used; usually, it has no associated cost, as in the case of Bancolombia and Davivienda.

ACH Colombia is the Automated Clearing House in charge of managing ACH transfers in Colombia, among which is Transfiya (also known as PSE).

Currently, Transfiya transfers work with these financial institutions in Colombia:

Daviplata

Nequi

Banco de Bogotá

BBVA

Bancolombia

Davivienda

Banco Caja Social

Av Villas

Movii

Scotiabank

Dale

Banco Falabella

Itaú

Banco Cooperativo

Banco de Occidente

Banco Finandina

Banco Agrario de Colombia

Bold

Confiar

Banco Popular

Bancamía

Bancoomeva

Serfinanza

CFA

JFK

Powwi

Banco W

Claro Pay

You can choose any of these institutions as your Transfiya key. Later we’ll see how to do it in general.

Transfiya only works for national operations. Remember that to send and receive dollars or euros, your best ally is DolarApp.

Transfiya promises you can make immediate transfers just by using the cellphone number of the money receiver.

Three key entities are involved in this process to make the money reach its destination:

Sending entity

ACH operator (ACH Colombia)

Receiving entity

Simply link a bank account or digital wallet of your choice (example: Nequi). Make sure it is linked to an active cellphone number.

Although with Transfiya you can register the same cellphone number in several accounts from different financial entities, you must choose one as the default or “activated” one to receive transfers.

It’s important to highlight that since this is a system supervised in Colombia, you must have a registered account with your citizenship ID or identification document. Transfiya works with savings or checking accounts.

The methods to receive money may vary slightly depending on the institutions used, but generally, the recipient will receive a notification asking whether they accept the Transfiya transfer.

In the “Main Transactions” section, go to “See all”

Click on “Receive money”

Then “Transfers to approve”

After accepting, you will receive a receipt on the transfer status

Remember you have 12 hours to approve or reject transactions.

However, it’s important to know that until July 14, 2025, Bancolombia users could register their bank accounts in the Transfiya system. If you didn’t do it before that date, now you’ll have to opt for the Bre-B system, which we review below.

First, you need to activate your Nequi account as your Transfiya account. Here's how to activate Transfiya in Nequi:

Go to settings

Click on “Your Nequi”

Then click on “Transfiya”

Finally, activate Nequi as your favorite

That’s it, now your Nequi is linked to the Transfiya transfer system.

When someone sends you money through this method, you’ll get a notification asking if you accept the Transfiya transfer, and once you do, the amount will be received.

Actually, if you already “sent” the Transfiya transfer, the only way to cancel it is for the recipient not to accept it, and the money will be returned.

You can also try to contact your financial institution or the person you sent the money to and try to resolve the issue.

According to Transfiya's official website, there is a daily limit of 5 million pesos per day to send or request transfers with its system. Also, only up to 15 daily transactions can be made.

However, these limits change depending on each financial institution’s rules. Here’s a list of real limits, from lowest to highest:

Banco de Bogotá: $600,000 COP

Davivienda: $2,000,000 COP

Banco Agrario: $2,000,000 COP

Banco Caja Social: $3,000,000 COP

BBVA: $3,000,000 COP

Bancolombia: $3,000,000 COP

Banco W: $5,000,000 COP

Banco AV Villas: $5,000,000 COP

Banco de Occidente: $5,000,000 COP

Banco Falabella: $5,000,000 COP

Coomeva: $5,000,000 COP

Nequi: $5,000,000 COP

Regarding commissions or associated costs, it’s important to clarify that sending or receiving money through Transfiya is totally free, although we recommend checking each financial institution’s specific policies.

At DolarApp we’re at the forefront of economic and monetary transaction topics. For this reason, we couldn’t ignore Bre-B, the new public transfer system that aims to transform financial movements in Colombia.

While Transfiya was created and is operated by a private entity like ACH Colombia, the new Bre-B system is a public infrastructure directly regulated by the Bank of the Republic.

Here we show you in a “Bre-Ve” way some differences between Bre-B and Transfiya:

Feature | Transfiya | Bre-B |

Origin and institution | Operated by ACH Colombia (private) | Operated by Bank of the Republic (public and regulator) |

Coverage and obligation | Voluntary network of financial entities (25+) | Mandatory for all financial entities in Colombia |

Identification keys | Cellphone, ID, email, alphanumeric code | Cellphone, ID, email, alphanumeric code |

Key-account linking | One number can be linked to multiple accounts | One number can only be linked to one account |

Transfer process | Immediate transfer but requires recipient’s acceptance | Fully automatic and immediate |

Limits | Up to $5 million COP/day, 15 transactions/day | Up to $11,552,000 COP per transaction, adjustable limits |

Interoperability and scope | Transfers between banks, digital wallets, cooperatives | Integrated with full national payments infrastructure |

User cost | Free transfers | Free transfers for first 3 years, later depends on regulations |

Availability | 24/7 | 24/7 |

User impact | Good access and speed, manual approval required | Greater ease, more keys, full service integration (P2P, B2B, ecommerce, etc.) |

As always, we recommend being cautious of scams related to bank transfers. Here are some tips:

Never open suspicious links, they may be phishing

Double-check all data before sending money

Be wary of “too good to be true” promotions

Don’t lend your cellphone — transfers can be made with just a tap

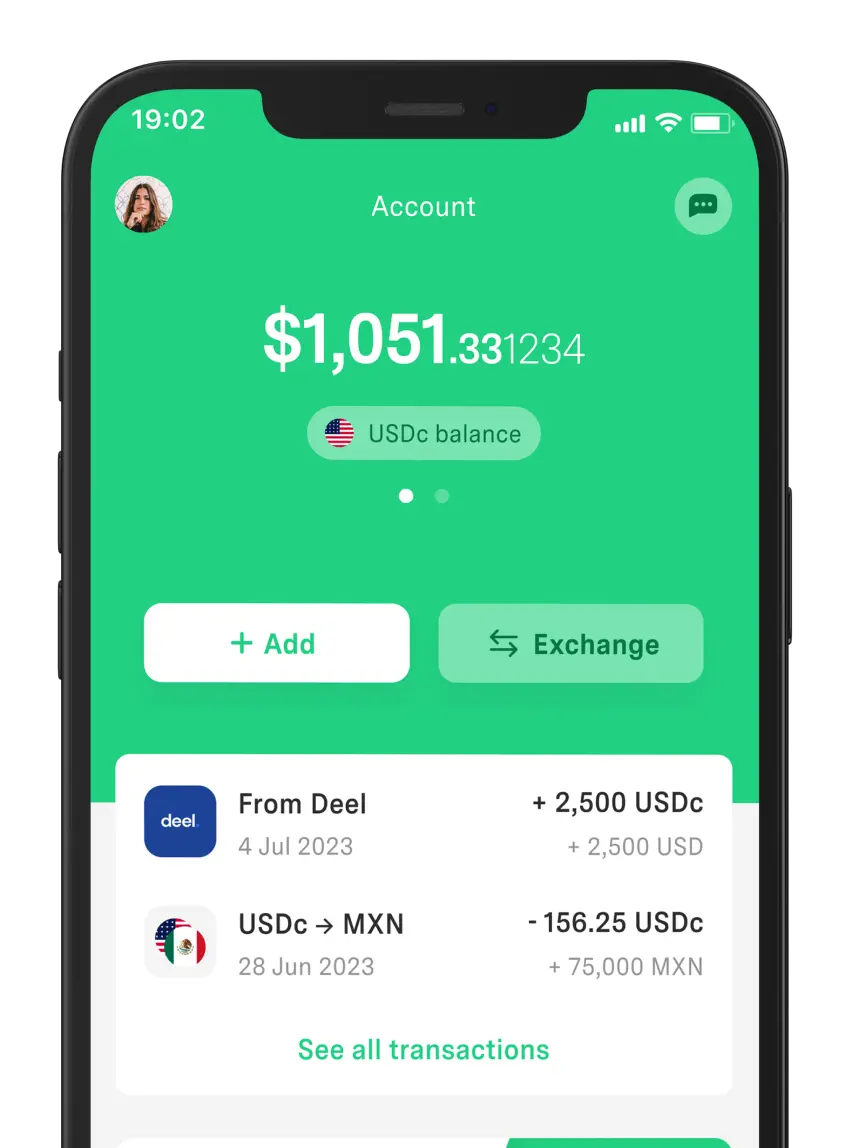

At DolarApp we offer the best digital dollar (USDC) and digital euro (EURC) management services, which is why we also provide value-added information related to financial management.

How long does a transaction take?

Transfers in Transfiya are immediate and are processed once the receiver accepts. If not accepted, the money is returned in 24 hours.

Can I use Transfiya if I’m not registered in that bank?

You must have a savings or checking account with one of the listed institutions and be a Colombian citizen. If not, you can’t receive the money.

What happens if I reject a money request?

The money is returned to the sender.

Can I receive from abroad?

No, Transfiya does not support international transfers. To make or receive international transfers, you can use DolarApp.

Transfiya was created to streamline banking operations among Colombians. While it works in most financial institutions, the new public infrastructure called Bre-B aims to change the game.

If you want access to a borderless financial system, we recommend using DolarApp, where you can manage USDC and EURC and transfer Colombian pesos at the best rate and with no hidden fees. You can also benefit from DolarCard.

The world has borders. Your finances don’t have to.

Your Money

Your Money The most stable currency in the world has managed to withstand crises, inflation, and political uncertainty. Discover which one it is and other stable currencies.

Your Money

Your Money Investing is transforming your current money into a more valuable resource in the future. Discover the types of investments and how to start now.

Your Money

Your Money Discover how to cancel a bank transfer. If it hasn’t been processed yet, you might have a chance to reverse the transaction.