Freelancer tips

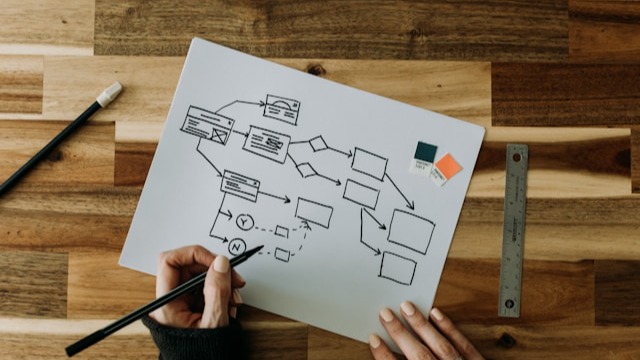

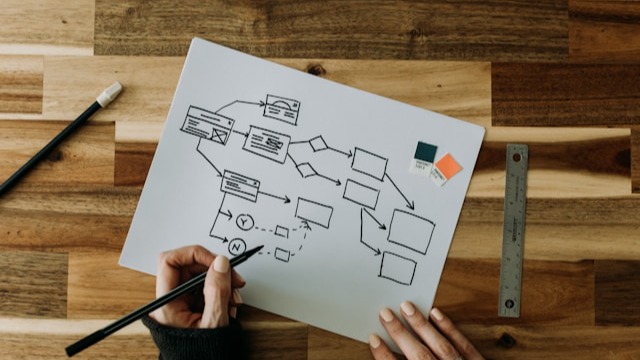

Freelancer tips Process Operations Diagram: What It Is and How to Make One

The process operations diagram helps organize tasks, improve productivity, and support better decision-making. Learn how to create one here.

Many freelancers only think of taxes and headaches with the SAT when they hear “legal entity.” For that reason, it's important to clearly understand what it actually means.

In the following lines, you'll discover what it is and the different types of legal entities in Mexico. You'll also learn about the related tax obligations and other useful details to determine if this model fits what you're looking for.

Take note...

A legal entity in Mexico is a legal construct represented by two or more individuals with a shared purpose. It may or may not have a profit motive, such as starting a business or forming an organization.

In Mexico, companies, civil associations, and many cooperatives operate under this legal structure. Although they do not have a physical existence, the law recognizes them as a “person.” Therefore, they can sign contracts, acquire assets, exercise rights, and be held accountable before authorities.

This structure allows the separation of assets and responsibilities between the members. It enables structured operations and compliance with tax obligations under a legal name.

Legal entities have features that define their nature and grant them legal personality:

Company name: This is the legal name used to identify the entity before third parties and authorities.

Domicile: The physical address where the administration is located and activities are conducted.

Nationality: Based on the country where it was legally formed. In this case, it is considered Mexican if incorporated according to national laws.

Assets: Composed of the entity’s own assets, rights, and obligations—separate from those of its members.

Legal capacity: The ability to act independently in contracts, legal procedures, and official matters.

Liability: In most cases, partners are liable only up to the amount of their capital contribution, protecting their personal assets.

If you’re planning to start a company, association, or other joint project, forming a legal entity provides you with a legal framework to operate. It also helps protect your assets and formalize your activities.

As a freelancer looking to formalize your income, you must understand the difference between a legal entity and a natural person. Why? Because the regime you choose will directly impact your taxes, responsibilities, and growth opportunities.

Although both models allow you to operate legally before the SAT, there are several differences between them.

Here are the main ones:

Aspect | Natural Person | Legal Entity |

Legal identity | Identified by full name (e.g., Juan Pérez). | Identified by a business name or corporate name (e.g., Constructora Delta S.A. de C.V.). |

Start of obligations | May engage in legal and tax activities upon reaching adulthood. | Tax obligations begin once officially registered. |

Nationality | May be of any nationality. | Considered Mexican only if created under national laws and domiciled in the country. |

Accounting | Must keep accounting records only if exceeding certain income thresholds or depending on tax regime. | Must keep electronic accounting and submit it to the SAT, regardless of income level. |

Relationship with SAT | Can pay taxes as an employee, professional, merchant, or other personal regime. | Operates as an independent entity with its own RFC and tax framework. |

When we talk about types of legal entities in Mexico, we’re referring to different legal forms that suit various purposes. However, they can be classified into two categories depending on the main objective for which they were created:

These are organizations created to carry out economic activities legally and in an organized way. Their main goal is to generate profits by selling products or offering services.

The most common are:

Commercial companies: These are the typical option for those who want to start a business, grow, and operate under a formal corporate structure.

Among this group, 3 stand out:

1. Corporation (S.A.): Requires at least two shareholders and allows capital to be divided into shares.

2. Limited Liability Company (S. de R.L.): Offers a more flexible model, ideal for small groups.

3. Cooperative Society: Designed for those who want to work together under principles of equity and mutual support.

Civil Society (S.C.): While not commercial, it can also operate with economic aims. It’s common among professionals who associate to provide services (e.g., legal, accounting, or architectural firms).

This category also includes credit institutions and other financial entities.

These are focused on social, educational, cultural, or community goals. They don’t seek personal profit but rather allocate all resources to fulfilling a cause.

The most common in this category are:

Civil Associations (A.C.).

Foundations.

Decentralized government agencies.

Of course, they must meet certain requirements to maintain their status and be eligible to receive donations or government support.

Common examples of legal entities in Mexico:

Type of legal entity | Representative examples | Field or common use |

Corporation (S.A.) | Grupo Bimbo, Cemex | Large companies with capital divided into shares |

Limited Liability Company (S. de R.L.) | Marketing agencies, online stores | SMEs with commercial focus |

Civil Society (S.C.) | Accounting firms, architecture studios | Organized professional services |

Cooperative Society | Caja Morelia Valladolid, Pascual | Production, savings, consumption, or collective work |

Civil Association (A.C.) | Local NGOs, sports associations | Non-profit projects |

Decentralized agency | Conacyt, INEGI | Public or academic services |

A legal entity before the SAT must comply with a series of tax obligations once it is legally constituted.

These responsibilities apply to both for-profit and non-profit entities. However, there are variations depending on the applicable tax regime.

Among the main tax commitments of legal entities are:

Registering with the RFC from the moment the entity is created and keeping tax information updated.

Requesting the e.firma (advanced electronic signature), necessary to carry out online procedures with the SAT.

Issuing Digital Tax Receipts via Internet (CFDI) for every income received.

Withholding taxes when paying for professional services, salaries, or fees, and reporting them correctly.

Filing an annual tax return, reporting income, expenses, withheld taxes, and other relevant operations.

Keeping electronic accounting, as required by the Federal Tax Code.

Storing accounting records for at least 5 years.

Making provisional ISR payments and final VAT payments, if applicable based on business activity.

Filing special notices and reports with the SAT, such as the Informative Return of Transactions with Third Parties (DIOT), when applicable.

The degree of complexity and detail may vary according to the regime. But in all cases, it is essential to maintain an orderly and updated tax management.

Do you work with foreign clients or plan to do so after establishing your legal entity?

DolarApp can help you manage foreign currency income.

That’s right—we operate with digital dollars (USDc) and digital euros (EURc). When receiving your money, you can convert it to pesos whenever you like, at a transparent exchange rate and with no hidden fees.

The perfect ally for any freelancer making the leap to a legal entity.

To begin, you must define the type of company and draft the articles of incorporation before a notary. You also need to obtain an RFC from the SAT, request the e.firma, and register the tax domicile.

Mainly ISR and VAT, but a legal entity may also be subject to other taxes. For example, IEPS if selling specific products like alcohol or tobacco, and ISAN when acquiring new vehicles. It all depends on the economic activity.

Yes, a legal entity can be dissolved by the decision of its members or due to causes established in its articles of incorporation. The process requires complying with legal, tax, and accounting procedures to formally close before the authorities.

Los países tienen fronteras. Tus finanzas, ya no.

Freelancer tips

Freelancer tips The process operations diagram helps organize tasks, improve productivity, and support better decision-making. Learn how to create one here.

Freelancer tips

Freelancer tips A business brings new challenges and decisions as it scales. Learn the stages of business growth and identify which stage you’re in.

Freelancer tips

Freelancer tips A well-written privacy policy makes users trust your site more. Here are the necessary elements and a practical example to create one.