Your Money

Your Money How to Cancel a Bank Transfer

Discover how to cancel a bank transfer. If it hasn’t been processed yet, you might have a chance to reverse the transaction.

Updating your tax address in the RFC is not something you have to do every day. That’s why, in some cases, it can be overlooked—especially if you’re in the middle of moving or handling other paperwork.

However, such an oversight can turn into a serious legal problem.

That’s why in this article we’ll talk about the fines and the time frame you have to report changes to your tax address in the RFC. You’ll also find the steps to update it online and what to do if you receive a financial penalty.

So, if you want to avoid unnecessary charges and keep your operations in order, keep reading.

The tax address in Mexico is the location that allows the Tax Administration Service (SAT) to find you for tax purposes. The definition may vary depending on the type of taxpayer:

If you are registered as an individual, it would be your primary residence.

If you register as a legal entity, it is the place where your business is managed.

Why should you keep it updated?

The tax address in Mexico serves as a reference point for tax audits. Like the Tax Mailbox, it’s necessary for receiving notifications or summons from the SAT. It’s the address they will visit in case of audits, if needed.

Is it the same as the commercial address?

Not necessarily.

The tax address is the one you register with the SAT and has legal and tax implications, whether as an individual or a legal entity. The commercial address, on the other hand, is the location where your economic activity takes place.

Filing your annual return late is not the only reason you can be sanctioned. Any change you make to your RFC and do not report to the SAT is grounds for a fine.

How much is the fine in 2025?

According to Article 80 of the Federal Tax Code, the fine amount varies depending on the infraction. Let’s look at each one and the applicable ranges:

Not reporting the change of tax address or doing so after the legal deadline. In this case, the fine ranges from $5,400 to $10,780 MXN for most taxpayers. For those under the Simplified Trust Regime (Régimen Simplificado de Confianza), the fine ranges from $1,800 to $3,600 MXN.

Registering an incorrect address. If you declare a false address, the fine can range from $4,480 to $13,430 MXN.

What is the deadline to update my tax address in the RFC?

You have 10 business days to submit the notice of change of tax address to the SAT. This period starts from the day the change occurs—for example, when you move.

Note: You can avoid the fine for failing to report the change if you update it spontaneously—meaning without the SAT requesting it. This exception is mentioned in Article 79, Section III of the CFF.

Receiving a fine for a transfer or for not updating your tax address in the RFC is a monetary consequence. However, it’s not the only negative effect, as:

Your Digital Seal Certificate (CSD) may be temporarily restricted. This would prevent you from issuing valid invoices, which is bad for any economic activity you conduct.

Your RFC could be suspended, leaving you unable to operate officially.

Tax refunds or other important tax procedures could be blocked.

If they visit and cannot find you at the registered address, the SAT may consider it non-compliance. The same applies in the case of desk audits or any enforcement procedure.

If they visit you and cannot find you at your registered address, the SAT could consider this a breach. The same applies in the case of cabinet reviews or any other audit procedure.

To avoid any issues with the SAT, you only need to take a few minutes out of your day to update your information.

Here are the steps for the process:

1. Go to the SAT portal and select the “Procedures” option.

2. Locate and click on “RFC,” then select “Change of address or Update information in the RFC.”

3. Log in with your RFC and password or valid e.firma.

4. Enter the details of your current tax address as required by the form. If there are changes to your phone number, street name, or numbering, be sure to register them.

5. Verify that all fields are correct and click “Continue.”

6. Sign the process with your e.firma and then submit it to complete the procedure.

7. A “Notice of update of tax status” will be generated, which you can download and keep as proof.

Many SAT procedures can be done online, including recovering SAT certificates. But if you want to submit changes in person, you can also do so—though it must be by appointment and with all required documents.

If you receive a fine for not updating your tax address in the RFC, do the following:

Update your tax address as soon as possible via the SAT portal.

If you believe the fine was unjustified or an error occurred, file a clarification either online or by scheduling an in-person appointment.

If the fine is justified, pay it within the indicated period and keep the receipt as proof.

It’s important to verify that your tax status has been successfully updated in the SAT portal to avoid misunderstandings and further sanctions.

Make sure to check for fines or debts with the SAT so you can act immediately.

Ignoring the update of your tax address in the RFC brings legal and financial consequences. Besides a fine, you could be excluded from the system, lose refunds, and even face more severe penalties for inconsistencies.

These are reason enough to stay up to date with your information.

Make the change in time and keep your finances in order. And if you run a business with customers outside of Mexico, consider DolarApp as your ally.

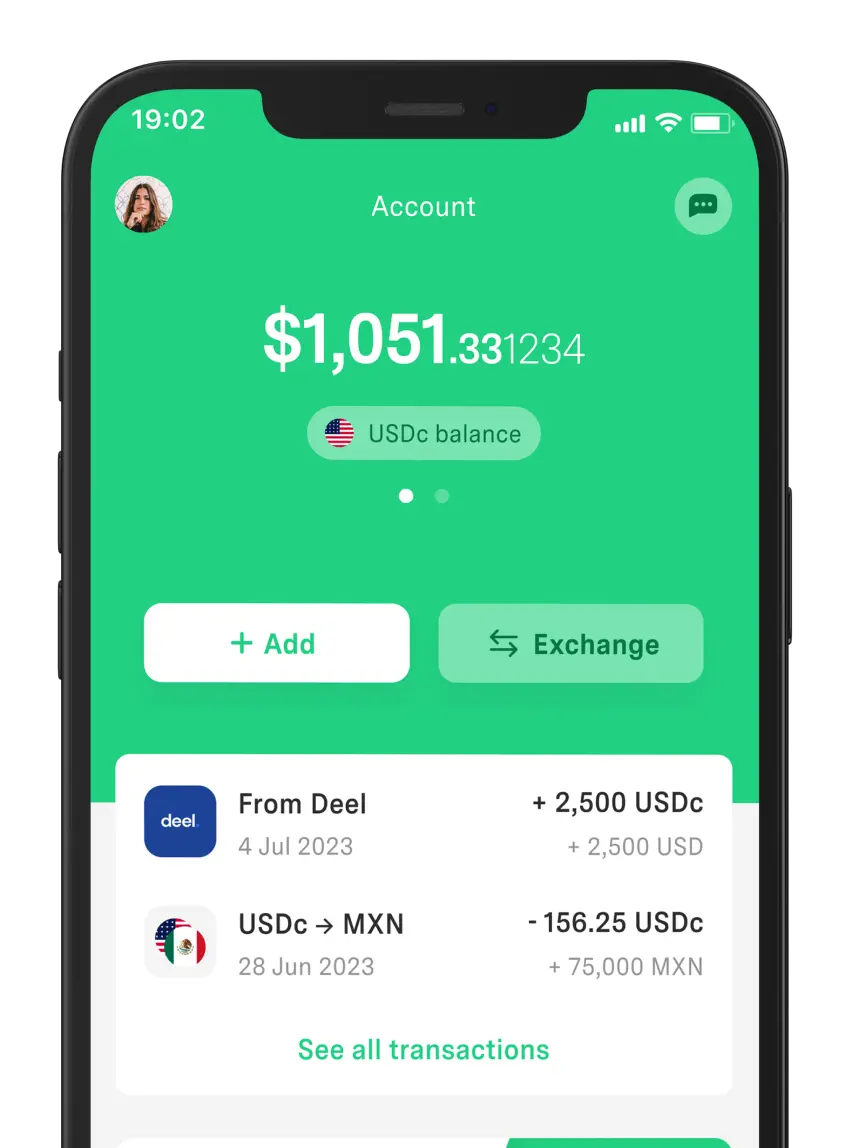

With DolarApp, you can receive digital dollars or euros from abroad directly. The transaction fee is 3 USDc or 3 EURc per transfer. However, if you send money to another DolarApp user, there are no fees.

The app also allows you to convert funds from MXN to USDc/EURc or vice versa, with a favorable exchange rate for your pocket.

Yes. You can do so as long as you have sufficient proof of your actual address. This can include utility bills, lease agreements, or some form of official proof that supports your tax status and can be presented.

You can register a virtual office with legal tax validity or request an address certificate from a local authority. But you must ensure that the space is related to your economic or administrative activity.

No. If you are registered in the RFC but have no economic activity and do not generate income, you are not obligated according to the SAT. You also do not have to file returns, so the fine does not apply in these cases.

Los países tienen fronteras. Tus finanzas, ya no.

Your Money

Your Money Discover how to cancel a bank transfer. If it hasn’t been processed yet, you might have a chance to reverse the transaction.

Your Money

Your Money Have you ever wondered how long it takes for a bank transfer to show up? Find out the timeframes associated with transfers in Mexico here.

Your Money

Your Money Your personal finances summarize your relationship with money. Discover why they matter and what to do to start managing them well.