Your Money

Your Money How to Cancel a Bank Transfer

Discover how to cancel a bank transfer. If it hasn’t been processed yet, you might have a chance to reverse the transaction.

Zelle was launched in 2017 as an instant payment service designed for U.S. bank accounts. Today, it’s one of the fastest and most secure ways to move money within the country. And for good reason, given its integration with over 2,000 banks and its near-instant functionality.

However, its popularity has extended beyond U.S. borders.

That’s why many ask: Can I open a Zelle account in Mexico? Which banks in Mexico offer Zelle?

This guide explains it all—from how it works to affiliated banks. Keep reading.

Zelle is a digital payment network that allows for immediate bank transfers between accounts within the United States. It was created by some of the country’s largest banks to make sending money between people who trust each other—like family, friends, and acquaintances—faster and easier.

Zelle is owned by Early Warning Services and has become deeply integrated into U.S. banking systems. So much so that its massive adoption stems from meeting a growing need: sending money fast.

How does it work?

The platform acts as a reliable bridge between thousands of U.S. financial institutions. This connection allows users to send and receive money in just minutes from a compatible bank.

In addition, Zelle allows you to make bank transfers in dollars without the need to share information and in a matter of minutes.

The essential requirements to open a Zelle account are:

Having a U.S.-based bank account that’s eligible for the service

A mobile phone number or email address with a U.S. domain—these serve as identifiers to send or receive money

Zelle is usually integrated into mobile banking, so you can activate it in just a few steps from your bank’s app. You won’t be asked to upload documents or verify your identity manually. That’s because the necessary information is already provided by your bank.

More than 2,000 banks and credit unions offer access to the Zelle network. Each one integrates it with its own terms of use, so features may vary slightly across institutions.

Most recognized Zelle-affiliated banks include:

Bank of America.

Wells Fargo.

US Bank.

Chase.

BB&T.

PNC.

Truist.

Capital One.

Citibank.

Which Banks in Mexico Have Zelle?

None. No Mexican bank is compatible with Zelle. The system operates only within the U.S. financial network.

Check the list of banks affiliated with Zelle.

No—Zelle isn’t available through Mexican banks. However, if you have an account at a U.S. bank that offers the service, you can set up a Zelle account from Mexico.

Here’s how:

1. Log in to your bank’s online platform or mobile app

2. Find the option that says “Join Zelle” or similar

3. Register a U.S.-based email or mobile phone number

Once completed, your account will be linked to Zelle.

We’ve already established that while Zelle isn’t available for Mexican bank accounts, you can use it from Mexico if you have a U.S. bank account. In that case, both sending and receiving money is fast and easy.

If your U.S. bank supports Zelle, you simply need to:

Access your bank’s mobile app or online banking

Look for the option to send, transfer, or pay, then select Zelle

Enter the recipient’s info and the amount

Confirm the transfer

Until recently, this could also be done through the official Zelle app. However, as of April 2025, Zelle is no longer available as a standalone app. It can only be used through participating banks or credit unions.

How to Receive Money via Zelle from Mexico

To receive money, the most important step is to be registered with Zelle via the mobile app or online banking of a U.S. bank. That way, the money will be deposited directly into your linked account.

If you’re not registered, no worries—you’ll receive a text or email with a link to claim the payment. You’ll need to:

Click the link to choose your bank

Complete the registration and activate your account by following the instructions

Once that’s done, the money will be sent automatically.

Note: When both users are registered with banks in the Zelle network, the transfer is nearly instant.

Zelle doesn’t set a standard limit for receiving money—those limits depend on the sending bank.

Here are the sending limits for some participating banks:

Bank | Daily Sending Limit | Monthly Sending Limit |

$3,500 USD | $20,000 USD | |

PNC Bank | $1,000 USD | $5,000 USD |

$3,500 USD | $20,000 USD | |

Ally Bank | $5,000 USD | $10,000 USD |

Level 1: $2,000 USD. Level 2: $5,000 USD. Level 3: $10,000 USD. | Variable |

Keep in mind that transfer limits can vary depending on your account type and banking history. Each bank sets its own policy.

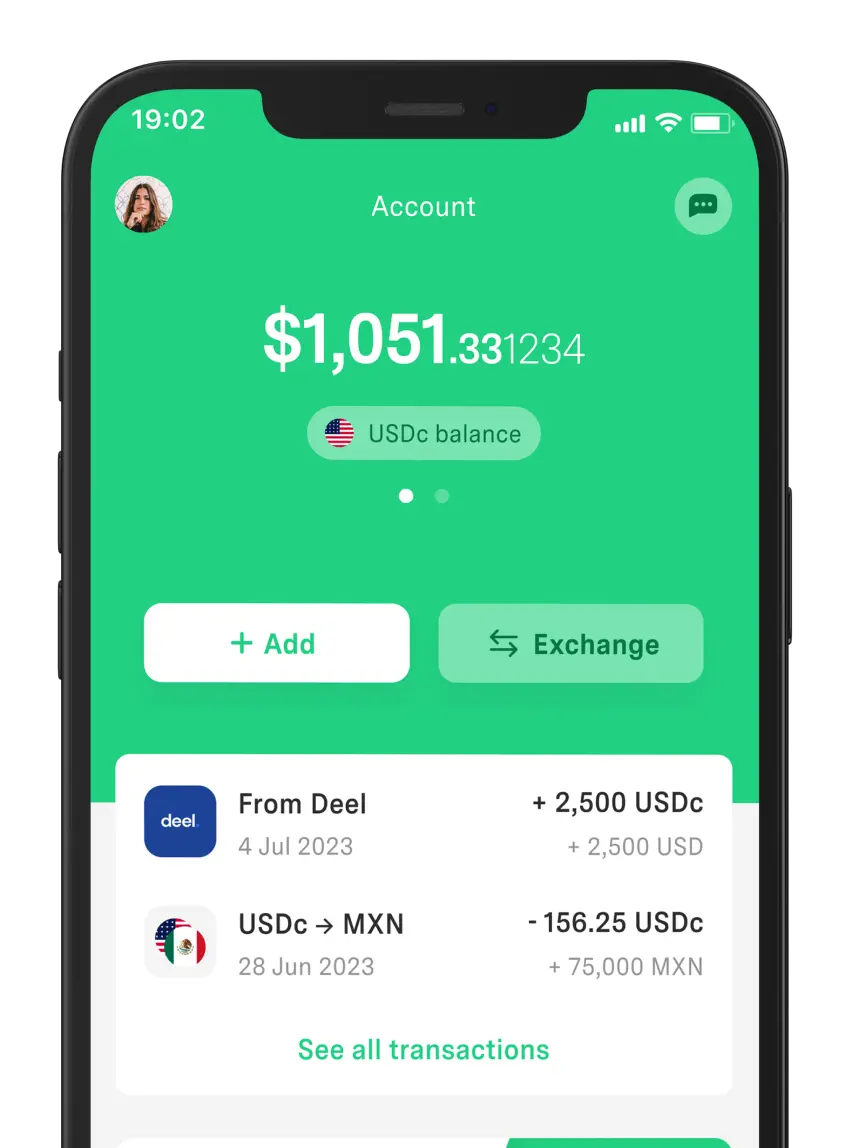

Need to send or receive payments from the U.S.? DolarApp is also a great choice—in fact, it’s a simpler and more practical option for people in Mexico.

Why? For three main reasons:

1. We operate with digital dollars (USDc).

2. You can access U.S. bank account details directly from Mexico.

3. If you want to convert your balance to pesos, you’ll get a fair exchange rate (for free)

If you’re familiar with traditional bank transfer requirements, you know the process can be slow and full of unnecessary steps. But with DolarApp, it’s much simpler. Just download the app and complete the verification process.

No need to worry about hidden fees either—we charge only one fee per transaction: 3 USDc for sending or receiving money.

You can also keep your balance in your account, send it to other users, or convert it to pesos—unlike many other international transfer methods.

Los países tienen fronteras. Tus finanzas, ya no.

Your Money

Your Money Discover how to cancel a bank transfer. If it hasn’t been processed yet, you might have a chance to reverse the transaction.

Your Money

Your Money Have you ever wondered how long it takes for a bank transfer to show up? Find out the timeframes associated with transfers in Mexico here.

Your Money

Your Money Your personal finances summarize your relationship with money. Discover why they matter and what to do to start managing them well.