Freelancer tips

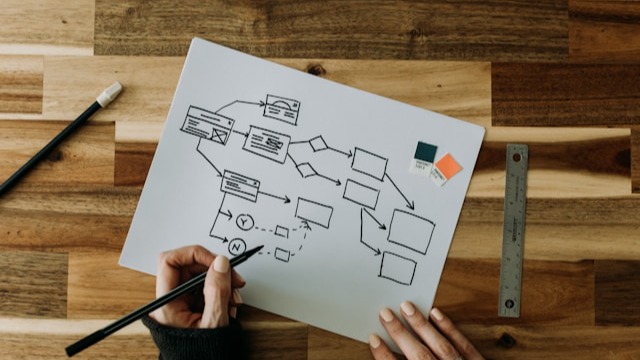

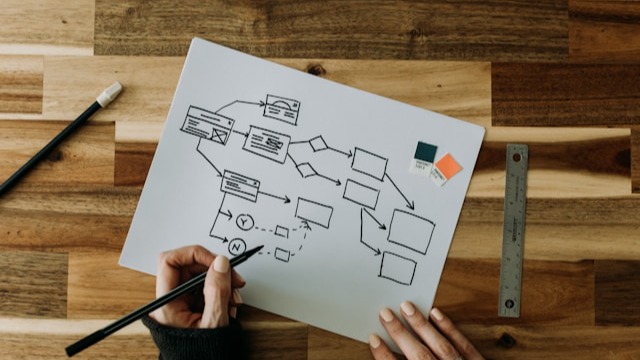

Freelancer tips Diagrama de Fluxo de Processos: o que é e como criar um

O diagrama de fluxo de processos ajuda a organizar tarefas, aumentar a produtividade e apoiar uma tomada de decisão mais eficiente. Saiba como criar um aqui.

A digital token is a unique identifier used in digital security to protect user data when carrying out online transactions. In other words, it’s applied in environments where authentication and information protection are essential to maintain trust.

More than a simple code, a token is an essential tool for managing your digital rights, your data, and investments—especially with the growth of digital banking, fintech, and blockchain platforms.

That’s why, in this post, we explain what a digital token is, how it operates, and why it has gained ground in modern digital security.

It’s an electronic representation of a value, asset, or credential that can be transferred or validated within a secure technological system. In simple terms, it’s a temporary code that replaces your real data and ensures digital security in your transactions.

However, not all digital tokens are the same—they depend on the context in which they’re used.

In general, they can be classified as follows:

Authentication token. These validate your identity or authorize transactions, such as the temporary code generated by BBVA or DolarApp’s biometric verification to confirm operations.

Financial or asset token. They represent an economic value or right (funds, shares, bonds, or participations) and allow for digital transfer or ownership. For example, security tokens or stablecoins that mirror the value of real currencies.

Utility or NFT tokens. They don’t seek to represent money, but rather access or digital ownership, such as NFTs that certify the ownership of a work or a virtual ticket.

In any case, the goal is to protect information and ensure secure operations in digital environments.

Digital tokens act like a secure pass that swaps your data for a temporary key. This process is known as tokenization, and it works as follows:

Generation. The system creates the code (token) linked to a specific transaction or identity.

Data substitution. Instead of sending the real data, the system uses the token as a secure identifier within the digital environment.

Validation and expiration. The token is used once to approve an action. It is then automatically invalidated, preventing reuse or duplication.

As a result, the risk of fraud and data theft is reduced, since the original data does not circulate over the network.

Digital tokens are used to protect operations and validate identities in environments where security is a priority. Their function is to prevent the misuse of data when authorizing payments, access, or digital signatures.

Generally speaking, they serve to:

Increase transaction security by replacing real data with encrypted codes.

Confirm that the person carrying out the operation is the legitimate holder of the account or service.

Prevent fraud and unauthorized access, since each token is temporary and only works within a given system.

Enable operations (logging in, signing contracts, or generating a digital proof of payment) without revealing sensitive information.

Guarantee traceability of operations and protection of user credentials in sectors such as blockchain or online banking.

For example, when you make a purchase with your DolarApp card, you may need to enter your passcode or receive a notification to authorize the payment. That verification functions as a security token, since it approves only that operation.

These validations can also be applied when paying for services or bills within the app.

Taken together, digital tokens strengthen system security and user trust in every operation.

Tokens and common passwords both allow you to access or confirm operations. However, a digital token provides a more advanced layer of security.

Here are the main differences:

Traditional password | Digital token | |

Nature | Static, created by the user. | Dynamic, automatically generated by the system. |

Use | Reused every time you log in. | Created for a single operation or specific session. |

Duration | Remains active until changed. | Expires after use or after a short period of time. |

Main advantage | Easy to use. | Strengthens authentication without complicating the experience. |

Digital tokens have been integrated across sectors to reinforce digital security.

They are present in:

Banking and fintech. Tokenization is applied to authorize operations in real time. For instance, PSE validations generate unique codes for each transaction to verify the user’s identity.

Cryptocurrencies and blockchain. Financial tokens are used in these environments for exchanges and decentralized operations within a secure network.

Digital payments. In systems like Oxxo Pay, tokens allow cash payments to be linked to a digital reference that confirms the operation.

E-commerce. Online stores substitute card numbers with tokens to process payments more securely, allowing you to use multiple cards (physical/virtual) without the risk of theft or duplication.

Electronic signatures and smart contracts. They facilitate authentication and traceability of documents in legal and business environments. As with DocuSign, which uses access tokens within the OAuth 2.0 flow.

These applications give us a small sample of the versatility and power tokens have in the digital age. Their constant adoption reflects how essential they are in the infrastructure we use every day for our transactions.

Digital tokens are vital in an increasingly connected ecosystem because they allow information to circulate more securely. Thanks to tokenization, financial, commercial, and technological systems can validate identities without exposing sensitive information.

At DolarApp, we use tokenization to keep your payment data protected with secure and transparent technology.

Download it and open your digital account to send or receive payments from Europe or the United States. We also offer a fair exchange rate to buy or sell USDc or EURc.

It’s an encrypted code that replaces sensitive information to authorize transactions and protect your identity in digital environments. This prevents data theft for logins, card numbers, or passwords, for example.

It’s used to represent and transfer economic value securely, enabling payments, investments, or exchanges without revealing banking information. It also guarantees authenticity, traceability, and greater protection in every operation.

A password is fixed and can be reused, while a token is generated for a single action and stops working after use. Therefore, it offers greater security and a lower risk of fraud.

There are multiple types of digital tokens. However, some of the most common include authentication tokens, financial or asset tokens, utility or NFT tokens, security tokens, and governance tokens. Each has specific functions depending on its use or technological environment.

Source:

Os países têm fronteiras. Suas finanças, não mais.

Freelancer tips

Freelancer tips O diagrama de fluxo de processos ajuda a organizar tarefas, aumentar a produtividade e apoiar uma tomada de decisão mais eficiente. Saiba como criar um aqui.

Freelancer tips

Freelancer tips A business brings new challenges and decisions as it scales. Learn the stages of business growth and identify which stage you’re in.

Freelancer tips

Freelancer tips A well-written privacy policy makes users trust your site more. Here are the necessary elements and a practical example to create one.