Cost structure: what it is, types, and how to create it step by step

What is a cost structure?

A cost structure is the model that organizes and classifies a business’s expenses into categories such as fixed, variable, direct, and indirect.

It’s a key tool for freelancers, entrepreneurs, SMEs, and larger companies, because it helps to understand where the money goes, how to set profitable prices, and make smarter decisions.

Having clarity about your costs not only avoids surprises in your cash flow, but also improves your profitability. That’s why it’s recommended to review it periodically, especially when the business grows or changes.

Types of costs in a business structure

To understand your expenses, it's essential to know how they are classified. Here's a practical breakdown:

Fixed costs

They don’t change month to month, regardless of whether you sell more or less. They are unavoidable and constant. Examples: rent, salaries, utilities, insurance.

Variable costs

They increase or decrease depending on your activity. If you produce more, you spend more.

Examples: raw materials, commissions, transportation, overtime.

Direct costs

They are directly linked to each product or service. Examples: supplies, production labor, packaging, distribution.

Indirect costs

Necessary for operations but not associated with a specific product. Examples: administration, marketing, cleaning, general services.

Unexpected or emergency costs

Even if not always classified as such, it’s essential to have a fund for unforeseen expenses.

How to create a cost structure step by step

If you’re in charge of creating the cost structure for your business or project, you can use Canva or even a template in Excel or a Google Sheets document (ideal if you want to keep it in your Google Drive).

Once you have your template ready, follow these simple steps:

Identify all your resources and activities

Make a complete list: from the obvious (rent, salaries, raw materials) to the less obvious (licenses, commissions, subscriptions). The more detailed, the better.

Classify your costs into fixed/variable and direct/indirect

A double classification will give you a deeper view. You can use colors or labels in your spreadsheet to organize them better.

Calculate the total cost per product or service

Add up the direct costs per unit and include a proportion of fixed costs. This helps you know whether you’re earning or losing money with each sale, service, or operation.

Analyze your profit margins

Subtract the unit cost from the sale price. Is your margin enough? This analysis reveals which products or services are truly profitable.

Review and optimize regularly

Costs change. Review the structure at least once per quarter or whenever your business goes through a major change.

You can even evaluate platforms like Asana to manage your operational processes more efficiently.

Example of cost structure (+ Template)

Let’s see how costs are distributed depending on the type of business:

Cost Category | Digital Agency (Services) | E-commerce / Fintech (Product) | Freelance / Consultant |

Operational | Team salaries, software licenses, occasional outsourcing | Product cost, logistics, customer service | Specialized software, external collaborators |

Administrative | Rent, basic services, accounting, general marketing | Office, services, administration (HR, legal) | Workspace, accounting services, personal marketing |

Technological | Hosting, web development, digital tools | Platform, servers, security | Personal devices, subscriptions, basic cloud |

Here’s a cost structure template in Excel that you can use as a reference or even to work on directly.

You might also be interested in reading a book on cost management.

How to optimize the cost structure

It’s not just about control, but about continuous improvement. These strategies will help you:

Automate processes

Time is also money. Automating repetitive tasks (like invoicing or reporting) saves you operational costs.

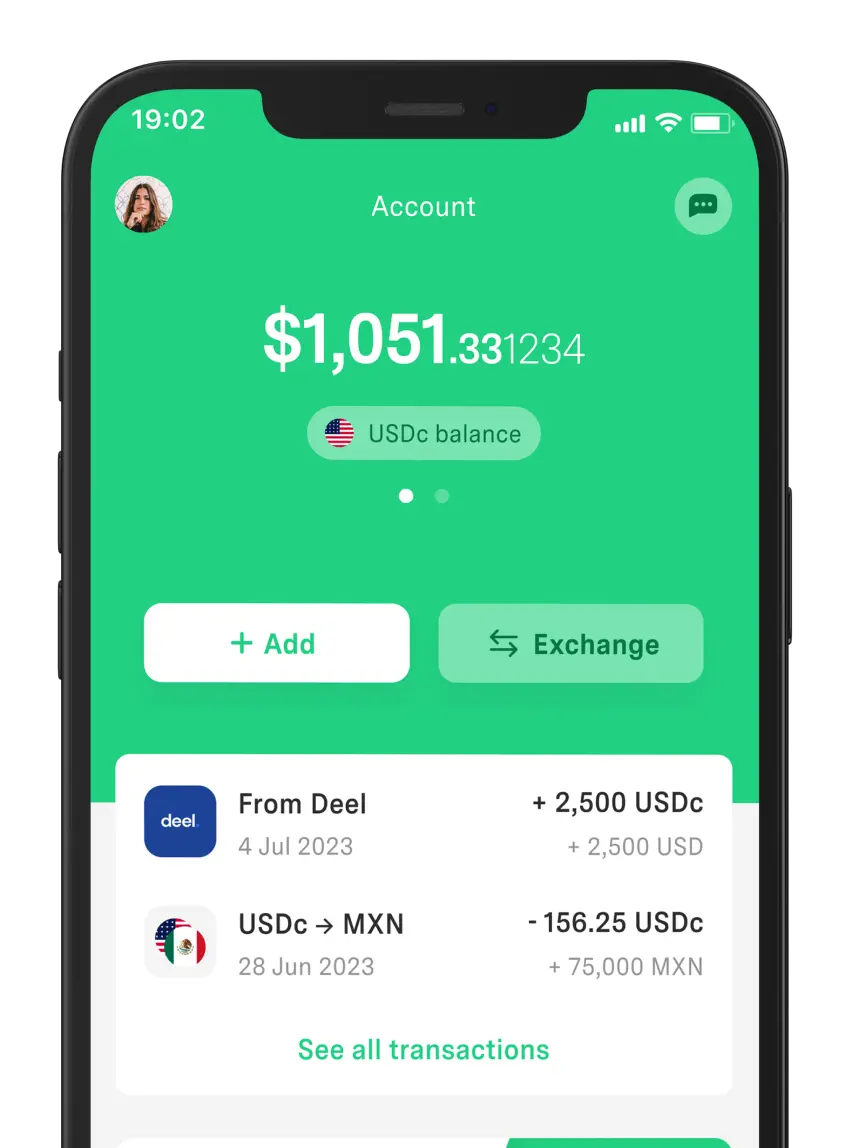

Use digital and fintech tools

Apps like DolarApp let you save on fees, operate in digital dollars, and manage expenses without surprises. Ideal for freelancers and businesses with international clients.

Negotiate with suppliers

Periodic price reviews, volume discounts, or better payment terms can make a big difference.

Monitor expenses in real time

Don’t wait until the end of the month. Use expense tracking apps or updated dashboards to react in time to any deviation.

Conclusion

Understanding your cost structure is just as important as generating income. It’s not just about knowing what you spend on, but having the power to adjust, plan, and grow intelligently.

Whether you're a freelancer, SME owner, or part of a startup, having a clear cost structure helps you:

Solutions like DolarApp let you manage your finances in digital dollars, with no exchange fees and total control from your phone. A solid cost structure, combined with modern technology, can be the difference between surviving and scaling.

FAQ (Frequently Asked Questions)

What does a cost structure include?

All expenses: operational, administrative, technological, fixed, variable, direct, and indirect.

How do fixed and variable costs differ?

Fixed costs remain constant (like rent). Variable costs change with activity (like raw materials).

Spreadsheets, accounting software, ERPs, and fintech apps like DolarApp.

How often should a cost structure be reviewed?

Ideally every month or quarter, and always when there's a significant change in the business.

Freelancer tips

Freelancer tips

Freelancer tips

Freelancer tips

Freelancer tips

Freelancer tips

Freelancer tips

Freelancer tips