Seu Dinheiro

Seu Dinheiro Best fintech for cross-border payments in 2026

Discover which fintech app is best for borderless transactions in 2026 with this quick comparison of total costs, speed, currencies, and methods.

A taxa de câmbio é um daqueles conceitos que muita gente só percebe quando vai viajar para o exterior ou recebe dinheiro de outro país.

Mas ela não se resume a números — as variações diárias podem fazer você pagar mais do que esperava ou receber menos do que imaginava.

Por isso, nos próximos parágrafos, vamos explicar o que é a taxa de câmbio e tudo o que você precisa saber sobre como ela influencia o seu dinheiro.

A taxa de câmbio indica quantas unidades de uma moeda são necessárias para comprar outra.

Por exemplo, se você acessar um site como o XE.com, verá que 1 dólar americano equivale a cerca de 5,36 reais, de acordo com a cotação do dia. Isso significa que você precisa de 5,35 reais para comprar 1 dólar.

No entanto, esses valores mudam constantemente — podem variar a qualquer momento devido a diversos fatores, como políticas econômicas, decisões do governo ou a plataforma usada para comprar dólares no Brasil.

Com o DolarApp, você pode acompanhar cotações em tempo real e realizar pagamentos com taxas competitivas.

A taxa de câmbio funciona como o “preço” estabelecido entre duas moedas — por exemplo, entre o dólar americano (USD) e o real brasileiro (BRL).

Como mencionado, esse valor pode subir ou cair conforme determinadas circunstâncias. Então, se você se pergunta como a taxa de câmbio é determinada, a resposta é: depende de uma combinação de fatores, entre os principais:

Decisões dos bancos centrais (como o Banco Central do Brasil)

A estabilidade econômica e política do país

A oferta e demanda pela moeda no mercado

O sistema cambial adotado por cada país também influencia — alguns governos controlam diretamente as cotações, enquanto outros deixam que o mercado defina o valor conforme as negociações.

A taxa de câmbio tem papel essencial na economia de qualquer país. Além de determinar o valor de uma moeda em relação a outra, ela impacta decisões comerciais, financeiras e de turismo, tanto no cenário interno quanto internacional.

A taxa de câmbio é determinante para o custo das importações e a competitividade das exportações.

Quando o real se valoriza, importar fica mais barato, mas exportar pode se tornar menos vantajoso.

Por outro lado, quando o real se desvaloriza, os exportadores se beneficiam, pois seus produtos ficam mais atrativos no mercado internacional — embora as importações fiquem mais caras.

O mesmo acontece com o turismo.

Imagine que a taxa de câmbio esteja favorável à uma moeda latina em relação ao dólar — nesse caso, você terá mais poder de compra ao viajar para o exterior.

Por outro lado, quando o dólar está mais valorizado, o Brasil se torna mais atraente para turistas estrangeiros, que passam a gastar mais aqui, aproveitando melhor o valor do seu dinheiro.

Uma economia com taxa de câmbio estável tende a transmitir mais confiança aos investidores internacionais. Isso pode gerar maior entrada de capital e impulsionar o crescimento econômico.

Em resumo, as taxas de câmbio são importantes porque refletem a posição de um país na economia global. Elas influenciam diretamente o crescimento, a competitividade e a capacidade de atrair investimentos e turismo.

Ao entender o que é e como funciona a taxa de câmbio, fica claro que ela impacta várias decisões do dia a dia — muitas vezes, sem que a gente perceba.

Seus efeitos são mais visíveis em operações internacionais, como viagens, envio ou recebimento de remessas e compras em sites estrangeiros.

Afinal, é a taxa de câmbio que determina quanto você realmente recebe ou paga em outra moeda — e até mesmo pequenas variações podem fazer grande diferença no resultado final.

Quando o real se desvaloriza em relação ao dólar, tudo o que é cotado em dólar fica mais caro para você — passagens aéreas, hospedagens, assinaturas digitais e até ingressos para atrações turísticas.

Por outro lado, se a cotação melhora e o real se fortalece, seu dinheiro rende mais nas viagens, permitindo aproveitar melhor o orçamento.

Quando a taxa de câmbio não favorece o real, produtos importados como celulares, notebooks e compras em sites internacionais (como o Amazon EUA) tendem a ficar mais caros, já que seus preços são calculados em dólar.

As variações cambiais também impactam os lucros de empresas e investidores, pois o valor final muda na conversão de moedas. Mesmo pequenas oscilações podem gerar grandes diferenças em operações de alto valor ou transações frequentes.

Sim. Quando falamos em taxa de câmbio, não existe apenas uma. Há diversas formas de cálculo e utilização, mas as mais comuns são:

O valor da moeda permanece estável, pois é controlado diretamente pelo governo, geralmente com base em outra moeda, como o dólar.

O valor varia de acordo com as condições do mercado, como inflação, política monetária e volume de comércio exterior.

É a referência internacional usada entre grandes instituições financeiras. Não é exatamente o valor que você encontra nos bancos ou casas de câmbio ao converter reais para dólares, mas serve como base para definir os preços.

Sempre que você troca dinheiro, verá duas cotações diferentes:

Compra: quanto o banco paga pela moeda estrangeira (ex.: quanto você recebe em reais por cada dólar).

Venda: quanto você paga para comprar a moeda (ex.: quanto custa 1 dólar em reais).

A diferença entre essas duas taxas representa o lucro do banco ou da casa de câmbio.

Definida por bancos, plataformas digitais ou casas de câmbio, inclui margens de lucro específicas de cada instituição.

É a forma mais comum de exibir a relação entre duas moedas — como se vê em sites como XE.com

Ela não considera o custo de vida ou os preços locais, apenas o valor direto de uma moeda em relação à outra.

Por exemplo:

1 USD = 5,60 BRL

1 BRL = 0,18 USD

Matematicamente, são equivalentes — mas a taxa de câmbio nominal é a que geralmente usamos no dia a dia.

As taxas de câmbio podem variar conforme a fonte e o tipo de transação. Veja abaixo uma comparação de valores oferecidos por diferentes provedores na data de hoje:

Provedor | Tipo de câmbio | Cotação atual |

Interbancário (mercado) | 1 USD = 5,36 BRL | |

Xe.com | Interbancário (mercado) | 1 USD = 5,36 BRL |

Banco do Brasil | Próprio (institucional) | Compra: R$ 5,35 / Venda: R$ 5,35 |

Bradesco | Próprio (institucional) | R$ 5,67 |

Caixa Econômica | Próprio (institucional) | R$ 5,57 |

Dolar App | Próprio (digital) | R$ 5,35 |

Cotações de referência em 3 de novembro de 2025.

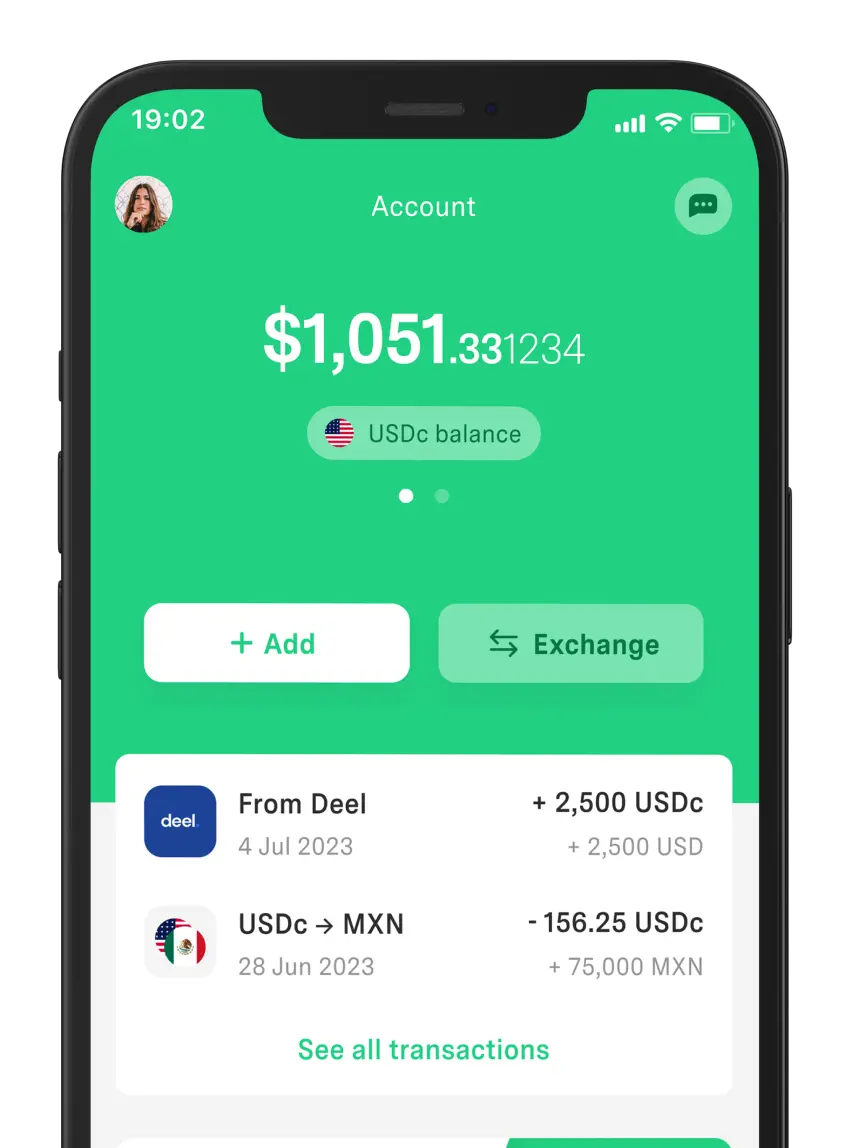

Precisa receber pagamentos do exterior estando no Brasil? Com a DolarApp, você faz tudo direto pelo celular.

A plataforma trabalha com dólares digitais e euros digitais, permitindo enviar e receber pagamentos internacionais de forma rápida e segura, com taxa fixa de apenas 3 USDc por transação.

Além disso, você pode comprar ou vender dólares digitais e euros digitais diretamente pelo app, com cotações competitivas e totalmente transparentes, sem taxas escondidas.

Quer gerenciar melhor suas finanças? A DolarApp é uma alternativa acessível, simples e transparente. Teste já!

Fontes:

XE.com - Converter Moedas

Amazon - Amazon USA

Google - Cotação do Dólar

Banco do Brasil - Converter Moedas

Bradesco - Converter Moedas

Caixa Econômica - Cotações Dólar

Os países têm fronteiras. Suas finanças, não mais.

Seu Dinheiro

Seu Dinheiro Discover which fintech app is best for borderless transactions in 2026 with this quick comparison of total costs, speed, currencies, and methods.

Seu Dinheiro

Seu Dinheiro A moeda mais estável do mundo conseguiu resistir a crises, à inflação e a períodos de incerteza política. Descubra qual é ela e conheça outras moedas consideradas estáveis.

Seu Dinheiro

Seu Dinheiro Investir é transformar o dinheiro que você tem hoje em um recurso mais valioso no futuro. Descubra os tipos de investimentos e como começar agora.