Freelancer tips

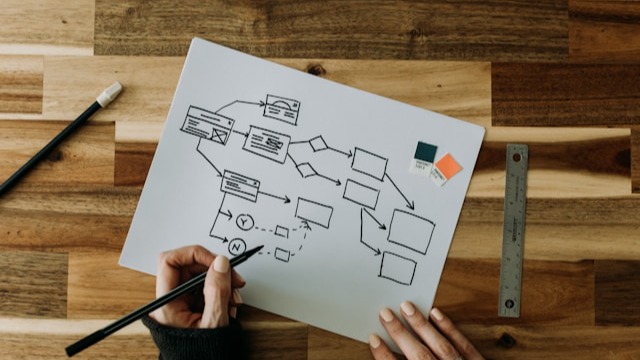

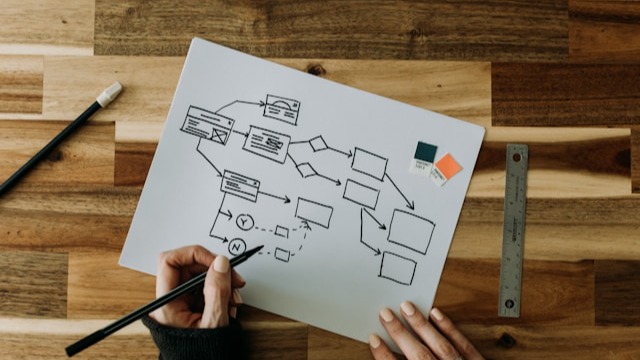

Freelancer tips Process Operations Diagram: What It Is and How to Make One

The process operations diagram helps organize tasks, improve productivity, and support better decision-making. Learn how to create one here.

More and more freelancers and entrepreneurs in Mexico want something very specific: to get paid in dollars and work with clients anywhere in the world. For some, an accessible path is to form an LLC in the United States. But how do you open an LLC from Mexico? Is it possible?

Yes, it’s possible. With the right requirements—such as a registered agent and your EIN—you can form your company online without residing in the U.S. Of course, there’s more to it, and we’ll walk you through all of it here.

However, please note that the following guide is for informational purposes only and does not constitute legal or tax advice. Some aspects may change over time and depending on the state, so it is advisable to review your case with an expert in both countries.

Without further ado, discover what a U.S. LLC is, its benefits, the essential requirements, and the step-by-step process to open one from Mexico.

An LLC (Limited Liability Company) is a common business structure in the United States that protects the personal assets of its owners. It also offers flexible “pass-through” taxation, which simplifies reporting profits without complex processes.

Essentially, it is a legal way to operate a business, such as a limited partnership, limited liability company, or other Mexican structural alternative.

For several reasons:

Limited liability. If the company takes on debt or faces a lawsuit, it is the business assets—not your personal assets—that are at risk.

Tax flexibility. Many LLCs operate as pass-through entities, allowing profits to be reported directly by the owners

Operational simplicity. It requires fewer formalities and paperwork, making an LLC attractive for digital businesses, services, and small ventures.

Access to the financial system. You can open bank accounts or financial solutions in the United States without complicated processes.

International invoicing in dollars. If you work for foreign companies, you can get paid in USD. You’ll also gain access to platforms like Amazon, Etsy, or Stripe that require a U.S. entity.

Best of all?

You don’t need to be a U.S. citizen or resident—U.S. law allows foreigners to own LLCs without living there.

However, an LLC does not grant residency, a work permit, or a U.S. visa. To immigrate, you’ll need specific immigration processes, for example, the E-2 investor visa.

Yes, it’s legal to open a U.S. LLC from Mexico.

Here’s what to know:

Multiple U.S. state laws allow foreigners to form an LLC without living in the country. For example, Delaware law does not require citizenship or residency to create an LLC.

You can create and manage the LLC from Mexico as long as the company complies with the rules of the state where it’s registered.

When you create an LLC outside Mexico, the company is considered foreign-owned for U.S. tax purposes (IRS Form 5472).

This can lead to certain reporting obligations in the United States depending on your business activity. If you remain a Mexican tax resident, you may also have obligations with the SAT for your income.

That’s why it’s advisable to get accounting support that understands your obligations in the United States to avoid tax mistakes. A specialist can review your situation and guide you based on your activity.

General requirements to open a U.S. LLC from Mexico include:

Choose a state of registration. Each state has specific costs and rules. Many Mexicans prefer Delaware, Wyoming, or Florida because they offer straightforward processes to form a U.S. LLC.

Available company name. The state requires that the name not be registered by another company and, generally, that it ends with “LLC” or “L.L.C.”

Registered agent in the U.S. You need a person or company with a physical address in the state of registration. This agent receives legal notices and official documents for the LLC.

Articles of Organization. This is the document that formalizes the creation of the LLC with the state. It specifies basic business information and the registered agent.

EIN (Employer Identification Number). This is the company’s tax ID with the IRS, used to operate, file taxes, and open bank accounts. Non-residents can request it with Form SS-4.

Operating Agreement. Defines how the company will function and the internal rules among members. It’s not always mandatory, but you’ll typically need it to open a business bank account.

Member documents. Generally, a passport and proof of address are required. Some institutions may also ask for an ITIN or additional tax information.

On another note, since 2024 many companies must report their beneficial owners to FinCEN via the BOI Report.

With that in mind, let’s look at how to open an LLC from Mexico…

The basic steps to open an LLC in the USA from Mexico are:

Thonfirm whether an LLC suits your business.

Choose the state where you’ll register your LLC.

Pick your LLC name and check availability.

Hire a registered agent in the United States.

File the Articles of Organization.

Draft your Operating Agreement.

Apply for the EIN with the IRS.

Open a bank account or financial solution for your LLC.

Stay current with your IRS and SAT obligations.

More details…

Evaluate your business type, expected income, and whether you need to invoice in USD or use platforms that require U.S. entities.

For some projects, a Mexican entity is enough; for others, a U.S. LLC helps build credibility and get paid in dollars with fewer hurdles.

Delaware, Wyoming, and Florida are common picks due to ease of registration and suitability for operating from abroad. But each has its own taxes, requirements, and considerations worth comparing before you decide.

It all depends on your model and whether you’ll need a physical presence in the U.S.

Choose a name not already registered in that state and compliant with local rules (e.g., include “LLC”).

Many states let you check availability via their official portals.

This is the person or company that receives legal notices and official documents for your LLC during U.S. business hours. If you operate from Mexico, you can hire a specialized service to act as your agent.

As noted, the Articles of Organization officially create your company. File them with the appropriate state office, along with the registration fee.

Today, in most cases, you can complete this online.

Even if you’re the sole owner, this document sets how the company will be managed, how decisions are made, and how profits are distributed. It’s often required for opening accounts and working with vendors.

The EIN is the tax number that identifies your LLC in the U.S., necessary for tax filings, banking, and payroll matters.

If you are a foreign national and do not have an SSN or ITIN, you will not be able to obtain one using the standard IRS online form; you will need to use Form SS-4.

Once you have it, you have three options:

Send it by fax.

Call the IRS international number.

Go to a specialized service that will handle the application for you.

If you’ll manage ongoing income in a stable currency like the dollar, consider fintech options for non-residents.

Nowadays, digital solutions can even simplify remote account openings from abroad. Unlike traditional banks, you may be able to operate without a physical U.S. presence, per each provider’s requirements.

At this stage, consider alternatives such as PayPal, Wise Business, or more practical solutions like DolarApp.

Once created, an LLC has maintenance requirements you can’t ignore.

In the U.S., these usually include:

Annual state reports.

IRS tax filings based on your activity.

And, as a Mexican tax resident, you must also report to the SAT for income received from abroad.

Don’t forget that consulting a specialist is the best way to avoid mistakes and penalties.

While a U.S. LLC can be very beneficial for Mexicans, it also has risks:

Invoice in U.S. dollars and operate within the U.S. financial system. This makes it easier to work with foreign clients and use digital services that only accept USD.

Protect your personal assets, since the LLC legally separates your personal property from business activities—provided you maintain proper structure and records.

Boost your professional image, because many platforms and international companies prefer dealing with U.S.-registered entities.

More remote opportunities with global companies that require dollar-denominated invoicing.

And while the dollar isn’t the most expensive currency in the world, it remains one of the most widely used for global business.

Upfront and recurring costs, such as state filing fees, the registered agent, and annual obligations. Depending on the state, the yearly amount can be significant.

Tax rules can get complex—especially if you don’t understand how LLC taxation works or how it interacts with your Mexican taxes. Errors can lead to fines or late filings.

Assuming an LLC protects you automatically. The reality is that protection is lost if you mix your personal finances with those of the company or manage the entity informally.

A U.S. LLC can open many doors if you understand the rules and manage it properly. With discipline and good advisory, the benefits often outweigh the risks.

Opening a U.S. LLC from Mexico is 100% possible and offers real advantages. You’ll be able to operate in dollars, protect your assets, and give your business a more professional, global profile.

However, you must keep orderly books and comply with tax and regulatory obligations—so it requires commitment.

Once you have it, use tools like DolarApp to collect and manage USDc from Mexico. We also support EURc and offer a fair exchange rate for currency conversion.

Yes. U.S. law allows foreigners to form an LLC without living in the country. You just need to meet basic requirements like choosing a state, hiring a registered agent, and obtaining your EIN.

Generally, select a state, hire a registered agent, provide ID (and other documents), obtain your EIN, and prepare an Operating Agreement. In some cases, you’ll also provide tax details.

No. An LLC doesn’t grant a visa, work permit, or residency. If immigration is your goal, explore specific options like the E-2 visa, always with specialized legal advice.

The company’s EIN and member documentation are often sufficient. But an ITIN may be requested later for tax, banking, or personal filing purposes. Its necessity depends on your activity and should be confirmed with a specialist.

As a Mexican tax resident, you must report your worldwide income to the SAT, including your LLC’s earnings. You may also have obligations in the U.S., depending on your activity. An accountant experienced in both countries can guide you best.

Sources:

The world has borders. Your finances don’t have to.

Freelancer tips

Freelancer tips The process operations diagram helps organize tasks, improve productivity, and support better decision-making. Learn how to create one here.

Freelancer tips

Freelancer tips A business brings new challenges and decisions as it scales. Learn the stages of business growth and identify which stage you’re in.

Freelancer tips

Freelancer tips A well-written privacy policy makes users trust your site more. Here are the necessary elements and a practical example to create one.