Freelancer tips

Freelancer tips Process Operations Diagram: What It Is and How to Make One

The process operations diagram helps organize tasks, improve productivity, and support better decision-making. Learn how to create one here.

Do you know what a general partnership is? It's a type of business entity in which several people come together for profit-making purposes.

A general partnership can be an attractive option if you're thinking about joining forces in a freelance environment. This model allows for the efficient combination of skills and competencies, and it can enhance your freelance career.

Want to learn more?

Continue reading this post, where we discuss the distinctive characteristics of a general partnership, including its types, the steps to establish one, and some specific examples of its application in different business sectors.

A general partnership is a business organization in which two or more people agree to participate under a commercial name.

For it to be fruitful, the partners must share the profits as well as the responsibilities for legal obligations and debts. It also requires an investment of money, labor, and time.

General partnerships are indicated by the initials “G.P.” (General Partnership).

If you're a freelancer in Mexico and considering creating a general partnership, make sure you understand its essential characteristics:

It is made up of capitalist shareholders, who provide the necessary money, and industrial partners, who work and receive a salary.

It is created under the name of one or more partners.

It is established by two or more people, whether individuals or legal entities, industrial partners, or capitalists.

There is no minimum capital for this type of partnership, so it can be started with as little as one Mexican peso.

Management can be handled by the partners or by external persons appointed.

There is a supervisor who oversees the actions of the administrators.

The liability of the partners is unlimited, joint, and subsidiary. They are liable for the obligations of the partnership with their contributed capital and assets.

There is no income limit, but it is imperative to allocate annually 5% of the net profits to the reserve fund.

Forming a general partnership in Mexico requires several legal and administrative steps. This ensures its proper creation and operation.

Steps to form a general partnership:

1. Request the commercial name through the Single Authorization Module, which can be done by one of the interested parties or a public notary.

2. Draft the partnership agreement.

3. Notify the use of the commercial name.

4. Register the partnership in the Public Registry of Commerce.

5. Register with the SAT (Mexican Tax Administration Service) to enroll the partnership in the Federal Taxpayers Registry and obtain its digital signature.

The process is simpler if you hire the services of a public notary, as they can handle almost everything.

The administration of this type of partnership is defined in the partnership agreement, designating the managers. If not specified, the capitalist partners assume this role.

If only one partner is the manager, they take care of all the administration. If there are several, each has the right to make decisions independently and does not need the rest to approve it.

However, it is rare to appoint a third party who is not a partner and has direct partnership participation as a manager.

Even though day-to-day operations follow the guidelines of the managers, decisions are made according to the partnership agreement.

General partnerships fall within the current types of commercial companies in Mexico. This, in turn, has several modalities:

These are those where the incorporation of new partners is a future possibility to increase the organization's capital.

In this model, it is required that partners only pay their contributions. That is, they do not respond subsidiarily, unlimitedly, nor jointly for social obligations.

Such contributions are in the form of money or assets. This means that their contribution can be with equipment or machinery, for example.

In this case, there is a maximum limit of 50 partners.

This type of partnership is very popular in Mexico for forming small and medium-sized enterprises, the famous SMEs.

The reason for this is that it combines the characteristics of the two previous modalities.

On the one hand, it allows the variation of the capital according to the contributions of the partners. On the other hand, they do not have unlimited liability, and their contributions are not represented by negotiable securities.

Creating a general partnership can be beneficial in your freelance career, but you should also consider some disadvantages.

Pros:

As a freelancer, you have the freedom to manage the partnership directly and make quick decisions. This will be useful to adapt to market changes and respond to client needs.

Working with trusted partners in this type of partnership can facilitate close and efficient collaboration, which is essential in creative and technical projects.

You do not need to invest a minimum amount to form it. Thus, it is accessible if you are starting as a freelancer and do not have large funds to start.

The possibility of having capitalist and industrial partners allows you to focus on your skills while the rest can handle the financing.

Cons:

Partners must risk their personal assets. This can be a significant disadvantage if the partnership is unable to face financial difficulties.

It can be difficult to attract new partners or investors due to unlimited liability, as not many are willing to take on high personal risk.

Entering and leaving the partnership requires unanimous consent.

This legal form may be ideal if you want direct control over the business. However, unlimited liability and administrative complexity are aspects that must be evaluated before deciding to create a general partnership.

When a general partnership is dissolved, a legal process called liquidation follows. This process consists of several phases:

1. First, the partnership is dissolved, either because it went bankrupt, due to the incapacity or death of a partner, or by joint decision of the involved parties.

2. After dissolution, one or more liquidators are chosen, who will carry out the liquidation process.

3. The next step is to sell the assets, which will be used to pay the debts and liabilities of the partnership.

4. If there are remaining profits after all debts are paid, they are distributed among the partners according to the size of their contributions.

Once all these points are completed, the general partnership is considered liquidated.

General partnerships are a viable option for freelancers who want to set up a business together. Any group of specialized individuals can benefit from a model like this.

General partnership examples:

Digital marketing agencies.

Architectural firms.

Human resources consultancies.

Law firms.

IT consultancies.

Advertising agencies.

Medical offices.

Public accounting firms.

Graphic design studios, among others.

As you can see, this legal form is common in multiple professions and services. You could create, for example, a content writing and editing agency for corporate content creation or blog and publication management.

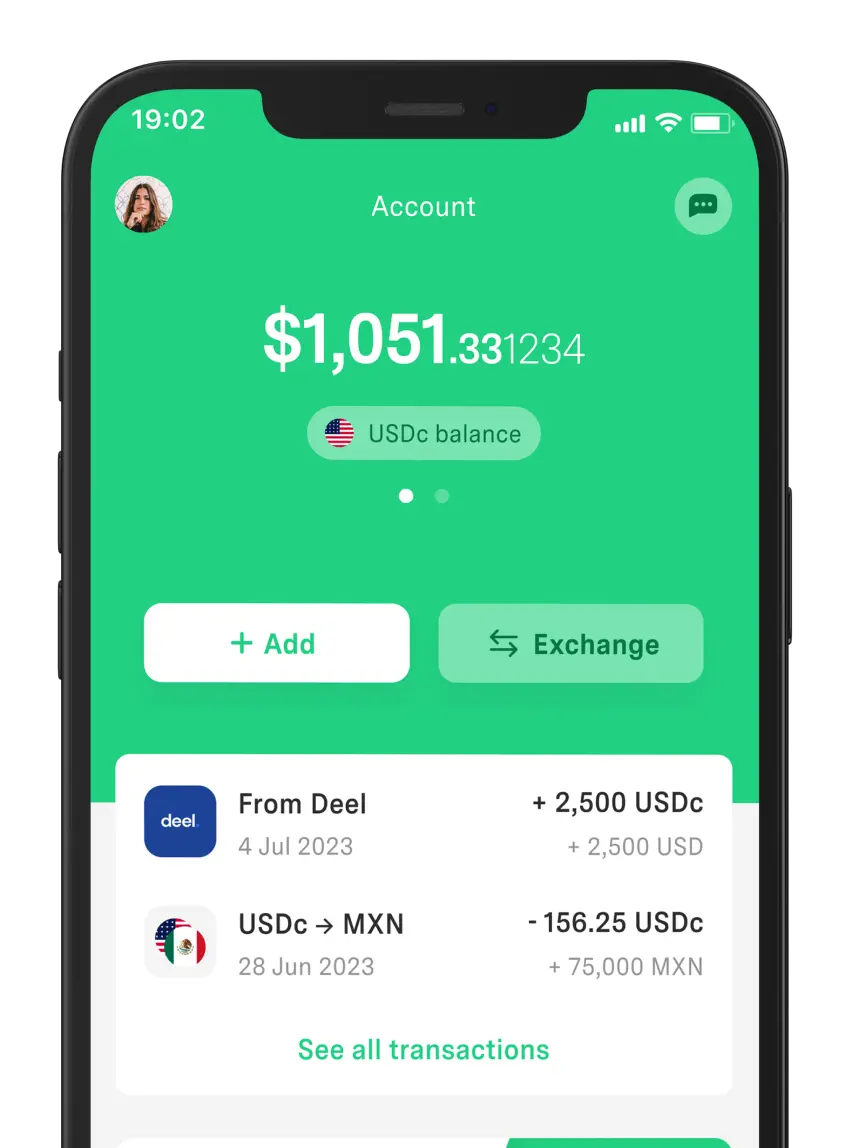

It all depends on the skills of the partner group. Additionally, you can charge through systems like DolarApp, in pesos or dollars. The most important thing is that there is trust and shared responsibility among the members of the partnership.

The world has borders. Your finances don’t have to.

Freelancer tips

Freelancer tips The process operations diagram helps organize tasks, improve productivity, and support better decision-making. Learn how to create one here.

Freelancer tips

Freelancer tips A business brings new challenges and decisions as it scales. Learn the stages of business growth and identify which stage you’re in.

Freelancer tips

Freelancer tips A well-written privacy policy makes users trust your site more. Here are the necessary elements and a practical example to create one.