Freelancer tips

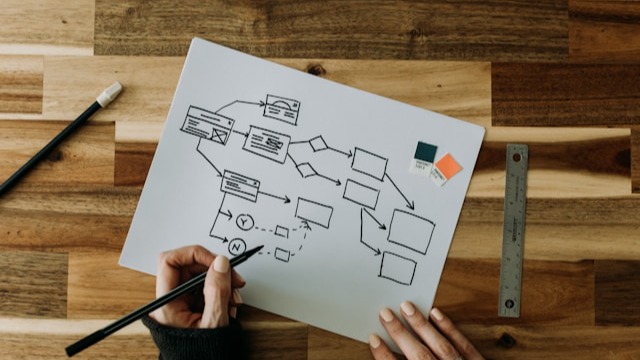

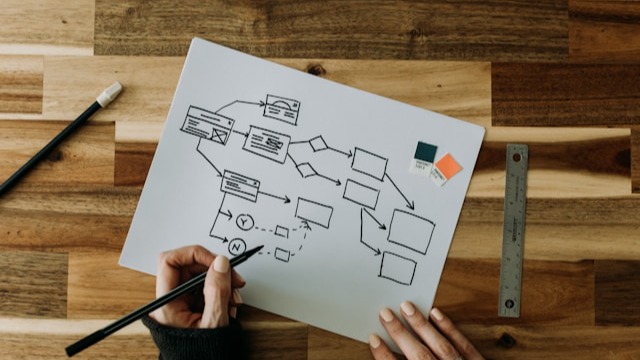

Freelancer tips Process Operations Diagram: What It Is and How to Make One

The process operations diagram helps organize tasks, improve productivity, and support better decision-making. Learn how to create one here.

RFM is a method for segmenting customers based on how recently they buy (Recency), how often they buy (Frequency), and how much they spend (Monetary). Thanks to these variables, companies, freelancers, e-commerce sites, or online stores can detect patterns that don’t usually appear in other reports.

RFM has become one of the clearest and most effective models for segmenting customers. The main reason is that it turns simple purchase data into clear segments that help prioritize actions and optimize strategy.

In this post, discover how RFM works and how to use it to optimize your campaigns and prioritize your most valuable customers.

RFM is a model that evaluates consumers’ purchasing habits through its variables:

Recency. Measures how long it’s been since a customer’s last purchase.

Frequency. Indicates how many times they buy in a given period to distinguish loyal customers from occasional ones.

Monetary. Shows how much money each customer spends on products or services.

These components let you analyze real purchasing behavior to understand each customer’s relationship with your business.

RFM analysis takes data from your customers’ purchase history and turns it into three comparable values. Next, you can group them into actionable segments.

How it works consists of:

Collecting the data.

Calculating RFM.

Assigning scores.

Grouping into RFM segments.

Launching campaigns for each segment.

Before calculating anything, gather the basic information for each customer:

Date of the last purchase.

Total number of purchases.

Amount spent within a defined period (for example, the last 6 or 12 months).

This data usually comes from your e-commerce platform, CRM, or billing system.

With the information collected, obtain three key values:

Recency: time elapsed from the last purchase to today, for example:

-10 days = very recent customer.

-200 days = almost inactive customer.

Frequency: total number of purchases in the period:

-8 purchases = very frequent customer.

-1 purchase = occasional customer.

Monetary: how much the customer has spent in that period.

You can use total spend or average ticket, depending on your business model.

Variable | What it measures | Example |

Recency | Days since last purchase | 10 days = highest score |

Frequency | Number of purchases | 12 purchases = active customer |

Monetary | Total expenditure | $8,000 = high value |

To compare customers with each other, these metrics are transformed into scores:

Choose a scale (for example, 1 to 5).

In Recency, the most recent customers receive the highest scores.

In Frequency and Monetary, high scores go to those who buy more often or spend more.

Thus, each customer gets an RFM code that essentially summarizes their behavior as a buyer.

The combination of scores reveals patterns that help you make decisions:

High scores across all three dimensions → very valuable customers.

Good frequency and spend, but low recency → customers possibly losing interest.

Low scores across the board → low-activity or nearly lost customers.

With this logic, RFM analysis turns scattered data into clear segments to decide where to focus your marketing and loyalty efforts.

With the scores in hand, the key moment arrives: applying RFM segmentation. This means classifying customers by their level of activity and value so that each group receives a different strategy.

While every business can adjust the names, some common segments you can use are:

Champions. Treat them like VIPs: presales or early access, priority service, and recommendations for higher-value complementary products.

Loyal customers. Encourage consistency with subscriptions, rewards for frequency, and benefits for staying with you.

New customers. Guide their first repurchase with a welcome, product recommendations, and an initial incentive to buy again.

Potential customers. Push them to take the next step by offering progressive discounts, product education, and nudges for a second purchase.

At-risk customers. Prevent churn with reactivation campaigns, personalized reminders, and limited offers to bring them back.

Lost customers. Try to win them back with a final recovery campaign and, if they don't respond, exclude them from advertising spend.

Once the segments are defined, you can plan a campaign schedule tailored to each group’s behavior.

Segmentation based on RFM allows you to tailor marketing actions in different ways.

Some of them include:

Adjusting communication frequency and tone according to the customer’s level of engagement.

Sending incentives to those showing signs of churn.

Rewarding those who buy more.

Personalizing recommendations based on their history and behavior.

For example, in an e-commerce setting, high-value customers can get early access or exclusive benefits. Meanwhile, those at risk receive reactivation messages.

Tip: if you want to visualize RFM segmentation and understand more quickly how they’re distributed, use graphic organizers.

Although implementing the RFM model requires significant effort and work, it’s worth it for the benefits it offers:

Predicts customer value. RFM scores help estimate which customers are most likely to keep buying and how much they may contribute long-term.

Personalizes your campaigns. Each segment receives different messages, offers, and content aligned with its engagement level and purchase history.

Increases retention. You can identify at-risk customers in time to launch specific campaigns and prevent them from leaving your brand.

Minimizes acquisition costs. By focusing on those most likely to respond, you reduce budget waste on generic campaigns.

Prioritizes resources on high-value customers. It helps decide where to invest more: exclusive benefits, better support, or advanced automations.

Additionally, if you combine the model with some AI tools, you can optimize classification and follow-up for each segment.

Imagine you have an online store called UrbanStyle dedicated to clothing and accessories and you want to analyze three customers. For this example, let’s assume we have purchase data from the last 12 months:

Customer | Days since last purchase (R) | # of purchases (F) | Total spend (M) |

Laura | 12 | 7 | $420 |

Mateo | 40 | 4 | $210 |

Sofía | 130 | 2 | $95 |

You use a 1–5 scale, where 5 is the best value in each dimension:

Customer | R | F | M | code |

Laura | 5 | 5 | 5 | 5-5-5 |

Mateo | 4 | 4 | 4 | 4-4-4 |

Sofía | 2 | 2 | 2 | 2-2-2 |

With these data, you can segment as follows:

Laura (5-5-5) → Champion: buys frequently, recently, and with high spend.

Mateo (4-4-4) → Loyal customer: maintains a stable, valuable purchase pattern.

Sofía (2-2-2) → Low-activity customer: limited history and low recency; may require incentives to return.

Then you can create a flowchart and visualize how each customer moves from RFM scores to a specific segment.

In e-commerce, RFM analysis is often applied from an email marketing platform like Mailchimp, which automatically creates segments.

These segments sync with your sales data or CRM and allow you to send more relevant messages without configuring complex rules. Plus, many tools include AI features that optimize subject lines, content, and audiences based on customer behavior.

In practice, you can use RFM to:

Use mass, low-cost campaigns for “Lost customers.”

Send launches, private sales, or VIP perks to “Champions and Loyals.”

Activate win-back flows for “At-risk customers.”

For organizing these campaigns, it’s also useful to make mind maps to break down ideas by segment. This way, you can ensure each group receives a message aligned with its behavior.

Misapplying RFM analysis can lead to confusing segmentations and ineffective decisions. To avoid this, watch out for these common mistakes:

Using poorly defined ranges. If day, purchase, or spend cutoffs don’t match real behavior, scores stop being useful.

Not updating data. Calculating RFM once a year falls short. Ideally, update it regularly (monthly or quarterly).

Not connecting RFM to real actions. Scoring is useless if you don’t then adjust your campaigns, automations, or offers for each segment.

Ignoring qualitative factors. The RFM model doesn’t capture everything—opinions, satisfaction, or customer context also matter.

Additionally, RFM analysis should be used as support, just like those remote-work tools that help keep data clean and actions coordinated.

RFM analysis is a great tool for understanding how your customers behave and making smarter decisions. By segmenting by recency, frequency, and value, you can identify who deserves priority attention, who needs reactivation, and which groups require a more differentiated approach.

If you apply the RFM model correctly, you’ll be able to personalize campaigns, improve retention, and optimize resources without needing complex processes. In short, it’s a useful tool for recognizing your most valuable customers.

And if you want to use more valuable tools, DolarApp is your best option for managing your finances and handling payments and collections in your business more efficiently.

Especially if you work internationally. In that case, DolarApp fits perfectly, since you can operate with digital dollars and euros from your phone. You also have the convenience of exchanging currencies at a competitive rate, whether you’re in Mexico, Colombia, Argentina, or Brazil.

RFM analysis is a method that classifies customers according to their recent purchases, how often they buy, and the value of their purchases. This lets you better understand their relationship with your business.

RFM segmentation serves to group customers by behavior, personalize campaigns, improve retention, and focus efforts on those who generate the most value. That way, you can define more precise strategies and optimize marketing resources.

RFM scores are calculated by measuring the days since the last purchase, the total number of purchases, and the accumulated spend. Then each value is converted to a comparative scale—usually from 1 to 5—to segment customers.

Any business with a purchase history can use RFM—from e-commerce, retail, and subscriptions to services and B2C brands. Especially when there are frequency, amount, and recency data that facilitate analysis.

Sources:

Los países tienen fronteras. Tus finanzas, ya no.

Freelancer tips

Freelancer tips The process operations diagram helps organize tasks, improve productivity, and support better decision-making. Learn how to create one here.

Freelancer tips

Freelancer tips A business brings new challenges and decisions as it scales. Learn the stages of business growth and identify which stage you’re in.

Freelancer tips

Freelancer tips A well-written privacy policy makes users trust your site more. Here are the necessary elements and a practical example to create one.